Image

By Jeff Roth

Is Home Affordability in the Ann Arbor Area a Pipe Dream or a

Realistic Goal?

By many measures, the Ann Arbor area has become increasingly

unaffordable for people.

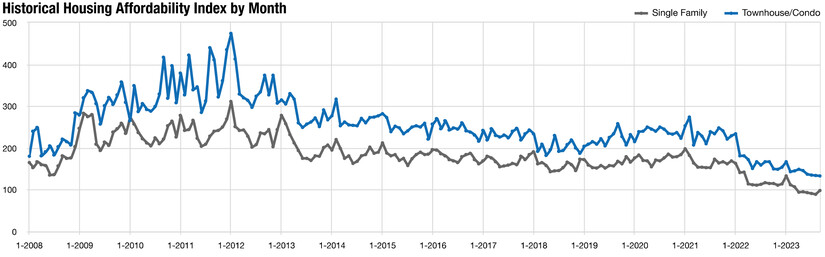

In fact, the Ann Arbor Area Board of Realtors has an Affordability Index

that they track every month. For example, an index of 120 means the

median household income is 120% of what is necessary for a median-

priced home with prevailing interest rates, or they have more than enough

income to afford a house. The higher the number, the greater the

affordability at that time.

Housing affordability has been falling, especially the last couple years, for

both single-family houses and townhomes/condos.

To give you some perspective, the median priced single-home in 2008

was $211,000 in the Ann Arbor area. Ten years later in 2018, the median

priced single-family home was $270,000 or an increase of 21.8%. By

2023, the median-priced house was $420,000 or a 35.7% increase in just

five years.

So, what can be done to make real estate more affordable for everyone?

Five things:

1. Buy during the time of year when real estate prices are statistically

lower (Ann Arbor area home prices are 30% lower in winter months).

2. Buy a condo instead of a single-family house (condos are 30% less

expensive).

3. Buy in a less expensive part of the Ann Arbor area (Ypsilanti’s

median sales prices are less than half of Ann Arbor, for example).

4. Buy using a down payment assistance program (The Ann Arbor

area is a targeted area for down payment assistance programs – up

to $10,000 in most cases).

5. Buy properties that need some work and love (this is a proven,

timeless strategy that still works).

So, even in the face of real estate being less affordable in the Ann Arbor

area, there are things we all can do to save money and make it more

affordable.

What Time of The Year is The Best Times to Buy Every Year?

Regardless of interest rates and record unavoidability in the Ann Arbor

area, one can always save money waiting to buy in the winter months.

This is true for both single-family homes and condos.

If you want to save money, the statistically best time to buy is January.

So, bundle yourself up, and if you can afford to wait to buy in the winter,

you can save yourself about 30% off typical spring/summer prices.

How Much Money Can You Save Buying a Condo Rather

Than a Single-Family Home?

If a condo fits your lifestyle and the association fees are reasonable,

buying one can save you a lot.

There are drawbacks to condos, of course, including: most condos do not

appreciate as much as a single-family house, home owners associations

can get in your business or limit what you do with your property, and your

overall return on investment is typically lower with condos.

On the plus side, however, townhomes/condos in the Ann Arbor area

generally sell for 30% less than single-family homes.

So, if a condo fits your lifestyle and you don’t mind the potential

drawbacks of owning a condo, it can be a great way to save some money.

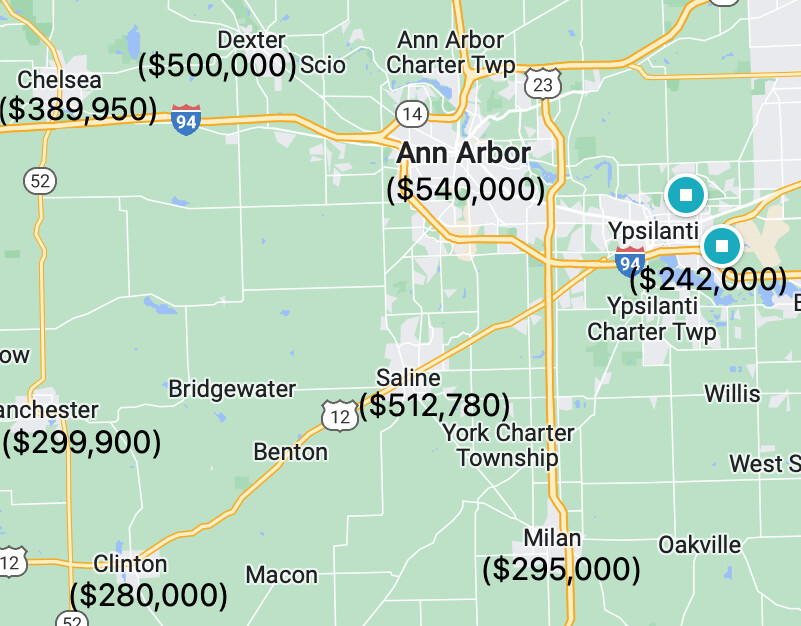

Which Parts of The Ann Arbor Area Are More Affordable?

Not surprisingly, some parts of the Ann Arbor area are much more

affordable than others.

In fact, Ypsilanti is about half the price of real estate in Ann Arbor and the

other immediate surrounding communities. Median sales price for Ann

Arbor was $541,000 in August 2023 and Ypsilanti was just $245,000.

If we look at median sales prices for August 2023, we can see that the

savings is true for both single-family houses and townhomes/condos in

Ypsilanti.

Some other rural communities to look at are Milan, Manchester, and

Clinton if you don’t mind the commute.

So, you can save some more money looking outside the more expensive

communities in the Ann Arbor area.

What Down Payment Assistance Programs Are Available in

the Ann Arbor Area?

Many people are surprised to find out that they may qualify for up to

$10,000 in down payment assistance in the Ann Arbor area. You receive

the $10k in upfront down payment assistance to lower your monthly payment

(very useful right now with mortgage rates where they are!), but automatically

pay it back upon selling the property.

In fact, a family of three or more can have a household income of

$173,600 and still qualify with a sales price limit of $224,500.

Because the Ann Arbor area has been historically unaffordable, it is a

targeted area for down payment assistance from such groups as the

Michigan Housing Development Authority (MSHDA).

You can find the MSHDA income limits to qualify for Washtenaw County

and other counties in the State here. You can learn more about MSHDA

programs here or by contacting them at the number below.

Bank of Ann Arbor is just one local lender that partners with MSHDA to

make owning Ann Arbor area real estate more affordable. You can learn

about Bank of Ann Arbor’s program here.

Bank of America has a program similar to MSHDA and is offered to the

Ann Arbor area. You can learn about their program here.

So, looking at your family’s income and ability to qualify may save you

money using down payment assistance programs to support home

ownership.

How Much Money Can You Save Buying a Property That

Needs Some Work?

Looking for a property that needs a little work can save you money when

buying. Plus, you can improve it to your tastes instead of buying someone

else’s upgrade.

Look for words in the property description that say “as-is,” “handyman

special,” or “motivated seller.”

So, depending on the amount of work needed and the motivation of the

seller, you can get a great deal on a fixer-upper anywhere in the Ann Arbor

area year-round.

Bottom Line for Making Ann Arbor Area Real Estate More

Affordable

Yes, affordability has been going down, but there are several ways

you can save yourself some money and making buying in the Ann

Arbor area more affordable.

First, bundle up and save buying in the winter.

Second, buy a condo instead of a single-family house.

Third, buy in a less expensive part of the Ann Arbor area.

Fourth, use a down payment assistance program.

Fifth, buy properties that need some work.

Obviously, to save the most money, try to use all five affordability

strategies.